The Kelly strategy is a type of gambling strategy that was created by J.L. Kelly Jr. in 1956 to help maximize a series of bets. It is known by several names—Kelly criterion or Kelly bet, in addition to the strategy name.

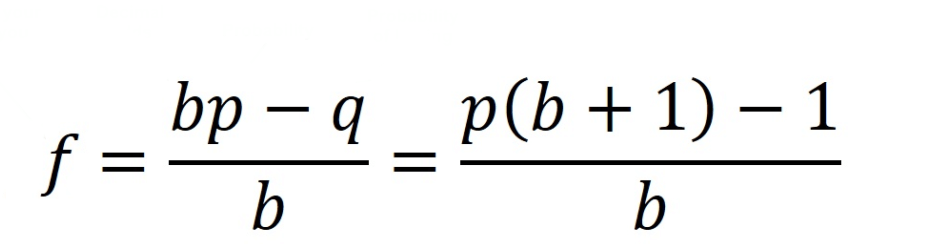

In short, the Kelly strategy is a way for gamblers (or investors in the stock market) to scrutinize the risks and rewards of any bet or investment. The specific formula is as follows: f* = bp-q/b = p (b+1) – 1/b. f* represents the amount of the bet or the current bankroll. The letter b stands for the odds received on the wager, or how much money you could win in addition to the money you’ve wagered. The probability of winning is indicated by the letter p, and q is the probability of losing.

For example, if a bet has a 20% chance of winning, then p = 0.20 and q = 0.80. In this particular case, 0.2×4.5 + 0.8×-1 = 0.1. As such, the suggested Kelly bet would be 2.22%, or 0.1/4.5.

This formula must be followed in order for the Kelly strategy to work. In the case of a gambler betting on a certain sporting event or card game, this type of bet is used to maximize bank roll growth. However, it also introduces more volatility that can cause short-term bankroll decline. It is a system designed with long-term profitability in mind, as opposed to immediate or short-term gains. In this respect, it shares similarities with value betting.

The best option is usually to bet less than the full Kelly amount. Even if this does lower growth, it also reduces the risk of losing higher sums of money quickly. By using the above formula, you can help determine how much or how little you should bet in a given situation. The Kelly strategy helps many professional gamblers calculate how much they should wager on any given bet, even if the odds are in their favor. This method also helps them even if they are winning, because it allows them to continue to bet even as they are winning pots, and thus capitalizing on their winning streak—and their bankroll.

In the future, we will provide a Kelly strategy calculator that should help simplify the process for those of you who might be math-challenged. This type of calculator can take your information—like your gambling bankroll, the odds of a particular game or bet, your odds of winning, the minimum bet allowed and what type of currency you’re using.

Of course, gambling is never a 100% guarantee so you should keep that in mind, even when using tools like the Kelly bet to maximize your winnings. Still, it’s a good way to do your research and help ensure you have a positive experience when making bets or investments.

As pointed out best option is to lower the sums given by the formula. In such a case we should call the new money management Fractional Kelly and calculate the sum to bet dividing (by 2 or 4 or more) the sum given by the 'Standard' Kelly. This is necessary since no punter has the ability to know the exact numerical margin of value he possesses over bookies odds. A final necessary step for me is to determine two things: a maximum percentage we are prepared to put in a single bet (for example 5%) and a maximum sum that we are ready to bet in terms of money (this last thing can be useful in case our bankroll is growing until a point where the sum given by the formula interferes with bookmaker's limits or as a temporary limit since we are not ready yet to bet the amount provided by the Kelly). All these expedients in my opinion make it the 'Perfect' money management for the long term winning punter. :)

2.22 % with winrate of 20 % good luck not busting your bankroll really fast

The thing about Kelly is that you need to be right not only that there is value to the bet, but also to how much value there is. Otherwise you may destroy yourself, even though you make value bets. It is one more danger you have.

Contrary to that, flat stakes takes out this source of uncertainty. That is why in the end, all end up by experience to flat stakes or at least few different levels of stakes.

Midway between the two is flat return, that is aim for a constant winning amound, say 10 units. So you bet 10 units on odds of 2 but 5 units on odds of 4 or 20 units on odds of 1.5

OMG , never do that !! If I use this formula for my usual bets (over 2.5) where I have a 75% success, with an average odds equal to 1.5, then I would have to bet 58% of my BR !!! Best way to go broke. Simply, I recommand to never bet over 5% of the BR (and adjusting the sum according to the trust we put in it)

Best strategy is expriences and find value in pick.

Can agree